Unlocking Potential: Why Cross-Border Processing is Crucial in Emerging Regions like Latin America and Africa

In an increasingly connected world, international trade has become a cornerstone for economic growth in many emerging regions, particularly in Latin America and Africa. However, this exchange of goods and services comes with significant challenges, especially when it comes to payment processing. This is where cross-border processing comes into play, a fundamental piece in facilitating financial transactions between different countries and continents.

The Importance of Cross-Border Processing

1. Facilitation of International Trade

In emerging regions like Latin America and Africa, international trade is a vital pathway for economic growth. Cross-border processing removes financial barriers and facilitates smooth transactions between businesses and consumers from different countries.

2. Access to Global Markets

For businesses in Latin America and Africa, expanding into foreign markets can be a strategic step to increase revenue and diversify operations. Cross-border processing enables them to accept payments from international customers efficiently and reliably.

3. Diversification of Income

By processing payments from a base abroad, businesses in emerging regions can diversify their sources of income. This provides them with greater financial stability by reducing their dependence on the local economy.

4. Fostering Innovation

Access to cross-border payment processing solutions fosters business innovation by enabling companies to explore new business models and adopt advanced financial technologies to improve efficiency and customer experience.

The Benefits of Processing Payments in the United Kingdom as a Base

The United Kingdom has been recognized as a leading global financial center, and its position in cross-border payment processing offers several advantages for businesses in Latin America and Africa:

1. Robust Financial Infrastructure

The UK boasts a strong financial infrastructure, including advanced payment systems and clear regulations that ensure security and efficiency in financial transactions.

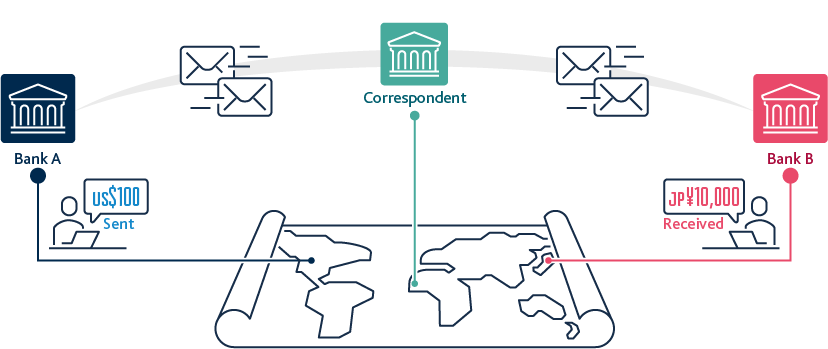

2. Access to International Networks

By processing payments from the UK, businesses gain access to established international networks, facilitating connections with banks and payment processors worldwide.

3. Regulatory Stability

The UK’s regulatory framework provides stability and transparency, giving businesses confidence and security in their cross-border financial operations.

4. Global Recognition

Processing payments from the UK can enhance the credibility and prestige of businesses in international markets, facilitating expansion and growth.

Quikly Pay: Your Partner in Cross-Border Payment Processing

At Quikly Pay, we understand the unique challenges that businesses in Latin America and Africa face when operating in a global environment. Our cross-border payment processing platform offers customized and secure solutions to help businesses make the most of international trade.

With Quikly Pay, businesses can:

- Access a global network of payment processing.

- Optimize currency conversion and minimize transaction costs.

- Comply with the most stringent security and regulatory standards.

- Receive dedicated support and expert guidance at every stage of the process.

Unlock your company’s potential in the global market with Quikly Pay. Contact us today to start your journey toward international success!